Table of Contents

Introduction

Splitwise 20m Series – As per the study by www.techcrunch.com, Splitwise, a providence, Rhode island-based startup, announced that it had closed a $20 Million Series A. This Series builds consumer fintech software that helps users split expenses. But splitwise is not a Venmo or Paytm clone. Instead of assisting the Series, users wire money to that pals. Splitwise helps to reduce the stress and awkwardness that money puts on relationships of all sorts.

The partners, married couples and roommates with distinct finances. It organized all its users shared expenses and IOUs in one place so that everyone could see who they owed. It sends all its investment users monthly reminders about outstanding debts. The application also provides its users with mediation advice about fairness issues through its fairness calculators. These calculators turn crowdsourced data into a neutral, fair opinion about its user’s situations.

Splitwise 20m Series – The product concept has also found a global audience. So, Splitwise has attracted tens of millions of registered users who have shared or managed what it calculated to be $90 Billion since 2011. Splitwise has long grown organically. As it could attract new users without paid spend, it managed to keep its costs low, which meant that it didn’t need to raise the venture capital at the same velocity as some other clients like fintech companies. However, by keeping their fundraising to a minimum, companies had to be a bit more careful where they displayed their resources.

What is Splitwise? Splitwise 20m Series

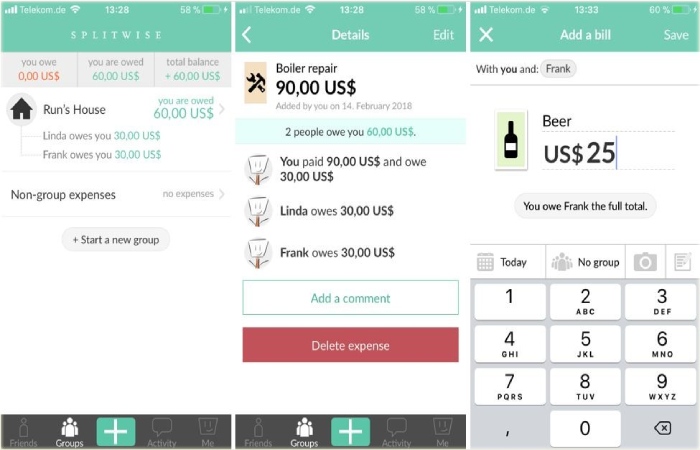

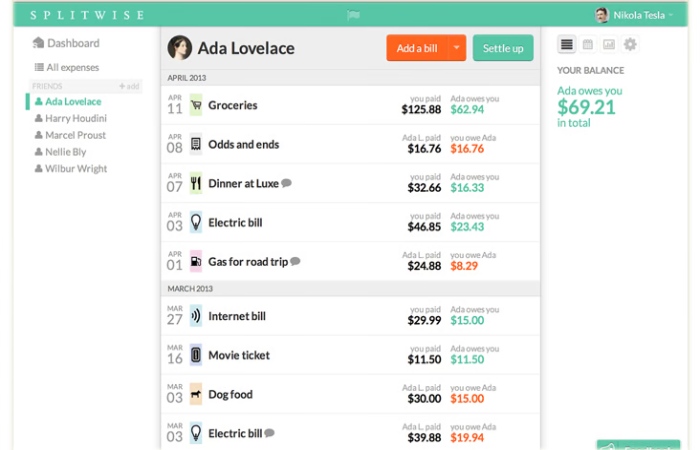

As per the study by www.splitwise.com, Splitwise is a providence, Rl-based company that helps to split bills with friends and families. It organizes all your shared expenses, and IOUs are one of the places. So, thats everyone can see who they owe moreover, whether you are sharing a ski vacation. Splitting the rent with roommates or paying someone back for lunch, Splitwise makes life significantly easier. It stores data in the cloud so you can access it anywhere on iPhone, Android or your PC.

The app is marketed for keeping track of informal debts, including the cost of rent, food and travel expenses, bills, and more. Splitwise, users enter notes into the app about who they owe, who owes them, and why. This service eliminates the need to keep receipts because a user can add any expense to the application when the cost is incurred.

Splitwise Alternative

According to the study by www.alternativeto.net, Splitwise describes itself as a “tool for friends and roommates to keep track of bills and other shared expenses, so everyone gets paid.” On the web, iPhone and Android!’ is an app in the security & privacy category. Hence, over 50 alternatives to Splitwise for various platforms, including Android, online/web-based, iPhone, Windows, and Linux. The best alternative is HomeBank, which is free and open to sources. Moreover, other great apps like Splitwise are Money Manager Ex, Firefly III, MoneyWallet, and Skrooge.

Splitwise 20m Series – Splitwise alternatives are primarily personal finance tools but can also be budget managers or online banking tools. So, Filter by these if you want a narrower list of alternatives or if you’re looking for specific Splitwise functionality.

Splitwise 20m Series

As per the study by www.alexanderjarvis.com, The Fintech startup splits has raised $20M Series in fresh funding. Moreover, Splitwise is a mobile application and web-based platform that helps its users share expenses.

Splitwise 20m Series – Furthermore, it includes roommates, travellers, couples, friends and family. Organize your users’ shared expenses and IOUs in one place so everyone can see who they owe. Send your users monthly reminders about outstanding debts. The app provides its users with mediation advice on equity issues through its equity calculators. These calculators turn crowdsourced data into a fair and neutral opinion about users’ situations.

Splitwise 20m Series 90b Wilhelm Techcrunch

As per the study by www.techcrunch.com, “It’s fascinating to grow the partnerships and customer base,” “We’re going to partner with exciting fintech that will allow us to do things we couldn’t before.”

“The Fintech infrastructure players out there will allow us to do some incredible things. In the US, the company investing partners with Venmo to help users exchange funds. As of April 2021, more than $90 billion in total transactions had been split on the Splitwise platform.

Splitwise 20m Series – The product concept has found a global audience. According to Bittner, Splitwise has attracted millions of registered users who have shared or managed an estimated $90 billion since 2011. So, the startup declined to share active user numbers, but as it is simply increasing a series A, we gave an early stage pass to more concrete usage metrics.

Wilhelm Techcrunch – Splitwise 20m Series

Alex Wilhelm is editor-in-chief of TechCrunch+. He previously worked for Crunchbase News as editor-in-chief, as well as The Next Web, TechCrunch, and Mattermark.

As per the study by www.c-span.org, Alex Wilhelm is a writer for TechCrunch with three videos in the C-SPAN Video Library; the first appearance was a 2014 Forum. Furthermore, The year with the most videos was 2015, with two videos. Most appearances with Jordan Crook (3), Aileen Lee (2), and Jonathan Shieber (2). Most common label: Science and Technology.

However, don’t expect it all the money to go into creating paid-only features. Splitwise made it clear to TechCrunch that it wants its free experience to be valuable enough that users are willing to invite their friends to the service without risking dragging them into an overly aggressive commercial digital environment.

Conclusion

In my content, I want to describe the Splitwise 20m Series. This Series builds consumer fintech software that helps users split expenses. But splitwise is not a Venmo or Paytm clone. Instead of assisting the Series, users wire money to that pals. Splitwise has long grown organically. The product concept has also found a global audience. Splitwise has attracted tens of millions of registration users who have shared or managed what it calculated to be $90 Billion since 2011.